Borr Paid MI Disbursed: Decoding Your Mortgage Insurance

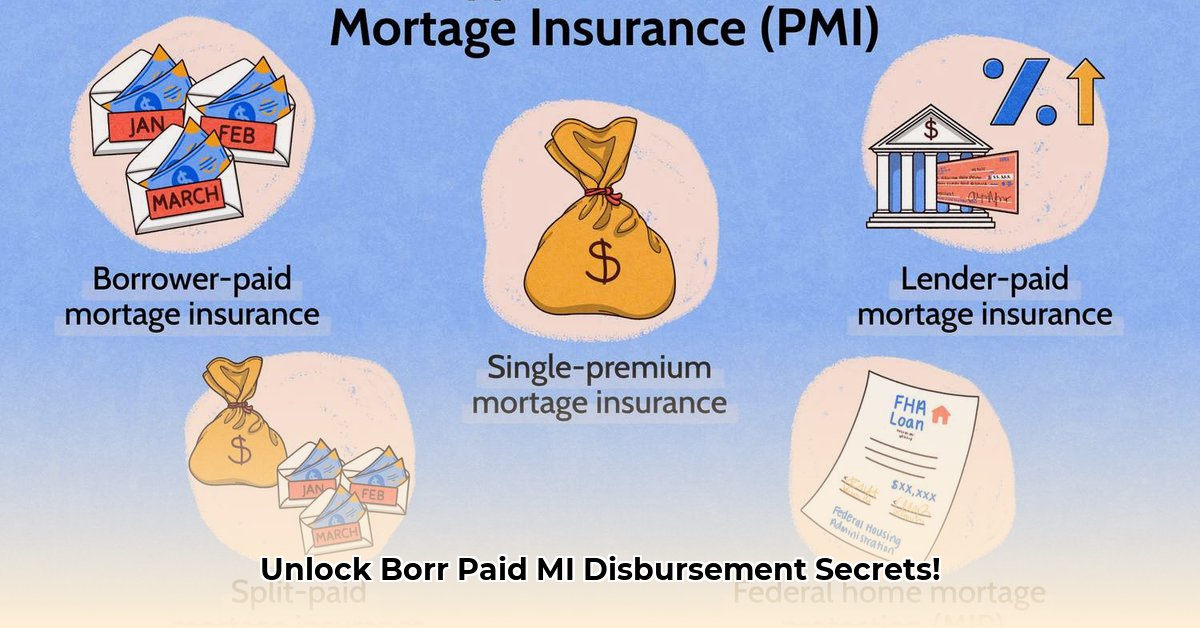

Buying a home is a significant financial undertaking, and understanding mortgage insurance is crucial. The term "Borr Paid MI Disbursed" simply means the borrower has paid their mortgage insurance premium, but the specifics vary greatly. This guide clarifies the process, comparing Private Mortgage Insurance (PMI) and Government-Backed Mortgage Insurance (GBMI) to help you make informed decisions.

What are the key differences between PMI and GBMI? PMI protects lenders when borrowers with less than 20% down payment default on conventional loans; it's typically canceled once you reach 20% equity. GBMI, found in FHA, VA, and USDA loans, protects lenders even with smaller down payments and is typically non-cancellable. How is the "Borr Paid MI Disbursed" amount calculated and handled for each? PMI premiums are usually paid monthly and vary based on a range of factors, including your credit score, while GBMI premiums are frequently incorporated into your monthly mortgage payment.

PMI vs. GBMI: A Detailed Comparison

Mortgage insurance protects lenders in case you can't repay your loan. PMI (Private Mortgage Insurance) is for conventional loans with less than 20% down payment. GBMI (Government-Backed Mortgage Insurance), covers FHA, VA, and USDA loans, often requiring lower down payments.

PMI:

- Pros: Potentially cancelable once you reach 20% equity, reducing your monthly payments. Also has the option for an upfront payment.

- Cons: Increases your monthly payments until equity reaches 20%. Costs vary with your credit score and other financial factors.

GBMI:

- Pros: Makes homeownership more accessible with lower down payments and potentially better interest rates.

- Cons: Generally non-cancellable; you pay premiums for the entire loan term. Premiums can be higher than PMI.

Which is right for you? The choice depends on factors like your downpayment, credit score, and financial goals. A financial advisor can help determine the best option for your specific situation. Is there a way to predict the amount "Borr paid MI disbursed" will be? No single equation exists, as the amount varies with factors such as property value, loan size, and the type of insurance—PMI or GBMI.

How Borr Paid MI Disbursed Works: A Step-by-Step Guide

Here's a clear breakdown of the process from application to monthly payments:

- Mortgage Application: Provide financial information, including income, credit score, and employment history.

- Insurance Selection: Your lender will discuss PMI or GBMI, explaining the pros and cons based on your situation.

- Underwriting and Appraisal: The lender assesses your financial risk and professional appraisers determine the property’s value.

- Closing: You sign paperwork; mortgage insurance is handled (lump sum or incorporated into monthly payments).

- Monthly Payments: Your monthly payment includes principal, interest, property taxes, home insurance, and any applicable mortgage insurance.

Important Note: The specifics of "Borr Paid MI Disbursed" vary among lenders and insurance types. Always ask clarifying questions. Are there any common pitfalls to look out for? Unexpected cost increases can occur as interest rates fluctuate. Always clarify any insurance costs with your lender to avoid unexpected charges.

How to Compare PMI and FHA Mortgage Insurance Costs Based on Credit Score

Choosing between PMI and FHA Mortgage Insurance Premium (MIP) depends heavily on your credit score and down payment.

PMI vs. MIP: A Cost Comparison

PMI (Private Mortgage Insurance) is for conventional loans, MIP (Mortgage Insurance Premium) is for FHA loans. Both protect lenders if you default, but their cost structures differ. FHA MIP costs are relatively predictable; PMI costs adjust based on scores and other financial factors. "How does credit score affect the cost of PMI?" A higher credit score often equates to a lower PMI premium. This is in contrast to FHA MIP, where credit score plays a less significant role in premium determination.

Comparing Costs: A Step-by-Step Guide

- Get Pre-Approved: Secure pre-approval for both FHA and conventional loans to receive precise cost estimates.

- Check Your Credit Report: A higher credit score significantly impacts PMI premiums (obtain a free credit report).

- Compare Monthly Payments: Examine itemized costs, including PMI or MIP, to compare options directly.

- Consider Long-Term Costs: PMI is usually cancellable; MIP may require refinancing for cancellation.

- Explore Loan Programs: Some conventional loans offer reduced PMI rates – discuss options with your lender.

Credit Score Impact and Illustrative Examples

Your credit score significantly influences PMI costs but has less impact on FHA MIP. The table below provides estimated annual PMI premium ranges based on credit score:

| Credit Score Range | PMI Annual Premium (Estimate) |

|---|---|

| 760+ | 0.46% - 0.75% of Loan Amount |

| 700-759 | 0.75% - 1.00% of Loan Amount |

| 660-699 | 1.00% - 1.25% of Loan Amount |

| 620-659 | 1.25% - 1.50% of Loan Amount |

(Note: These are estimates; actual rates vary. Always obtain personalized quotes.)

This table illustrates that higher credit scores typically mean lower PMI premiums. FHA MIP however, is usually fairly standardized, meaning a better credit score helps you qualify but does not significantly reduce your premiums.

Your Action Plan: Making Informed Decisions

- Shop around: Compare offers from multiple lenders.

- Ask questions: Clarify anything unclear with your lender or a financial advisor.

- Read carefully: Thoroughly review all documents before signing.

Understanding mortgage insurance is key to responsible homeownership. By taking the time to understand the nuances of PMI and GBMI, you can navigate the home-buying process with greater confidence and make the best financial choices for your future.